39 arizona department of revenue

Arizona revenue better than expected in February despite ... (The Center Square) - Revenue was down in Arizona last month from last year, but it was better than expected. According to the Arizona Joint Legislative Budget Committee, the state's general fund collected $725 million in February 2022. It was a 12.5% decrease in revenue compared to February 2021. Arizona Department of Revenue extends call center hours ... TUCSON, Ariz. (KOLD News 13) - The Arizona Department of Revenue (ADOR) will be offering extended call center hours to assist individual filers this tax season. The expanded hours are as follows: Monday through Friday, beginning March 21: 7:00 a.m. - 7:00 p.m. Saturday, April 2, 9 and 16: 8:00 a.m ...

AZTaxes - Arizona Department of Revenue AZ Web File is available to Payroll Service Providers to save time, money and paper and to meet the requirements to electronically file and pay Employer Withholding.

Arizona department of revenue

Arizona Department of Revenue (ADOR) Events | Eventbrite The Arizona Department of Revenue's (ADOR) Education & Outreach District serves as a liaison between the department and the state's cities, towns and municipalities. Our division consists of three areas: City Services Unit, Education Unit, Compliance Programs and Specialty Tax Program Teams. All our staff members are here to serve Arizona's taxpayers to the best of our ability. Arizona Department of Revenue warns of identity theft this ... The Arizona Department of Revenue urges taxpayers to file early to avoid being the victim of a fraudulent tax return as well. The department urges those who have been a victim of tax-related identity theft to contact the Department of Revenue's Identity Theft Call Center at (602) 716-6300, toll-free: 844-817-9691, or ... Arizona Department of Revenue holding Unclaimed Property ... The Arizona Department of Revenue is holding an online public auction of unclaimed property items starting Wednesday, Jan. 19 at 3:00 p.m.

Arizona department of revenue. Arizona Hits Recreational Marijuana Sales Record, With New ... By David Abbott, Arizona Mirror. Arizona cannabis sales continued on an upward trajectory in 2021, with the Arizona Department of Revenue reporting more than $1.23 billion in combined cannabis sales through the first 11 months of the year. In November, adult-use recreational cannabis sales hit a new peak and crossed $60 million for the first time. Arizona Department of Revenue's unclaimed property auction ... The Arizona Department of Revenue's Unclaimed Property Unit has worked for years to get unclaimed property back to its rightful owners. In the last fiscal year, more than $48 million was paid. Arizona Department of Revenue - AZDOR The Arizona Department of Revenue (ADOR) is urging businesses to renew their TPT licenses, which are due January 1, 2022. TPT licenses are valid for one calendar year, from January 1 through December 31. Taxpayers must renew the license before continuing business in Arizona. Failure to renew, or renewals after January 1, will incur penalties ... Quick Links - AZTaxes Arizona Department of Revenue; State of Arizona; Login; Welcome to AZTaxes Notifications • Notice: If you are having issues logging in, filing or paying taxes, use these troubleshooting tips: Try another browser, edit your bookmarks or clear your internet history and cache.

Arizona Legislature approves 15-week abortion ban | WGN ... PHOENIX (AP) — The Arizona Legislature on Thursday joined the growing list of Republican-led states to pass aggressive anti-abortion legislation as the conservative U.S. Supreme Court is considering ratcheting back abortion rights that have been in place for nearly 50 years. The House voted on party lines to outlaw abortion after 15 weeks of pregnancy, […] Arizona Department Of Revenue Set To Auction Unclaimed ... The Arizona Department of Revenue (ADOR) will hold an online public auction of unclaimed property items from abandoned safe deposit boxes beginning Wednesday, January 19, 2022. Items for sale will include jewelry, coins, currency, and a variety of collectible items that have not been claimed by their owners after many years. Unclaimed Property Auction Online... ARIZONA DEPARTMENT OF REVENUE - azstatejobs.gov ARIZONA DEPARTMENT OF REVENUE Funding Arizona's future through excellence in innovation, customer service, and continuous improvement. The Arizona Department of Revenue is consistently striving towards recruiting individuals who are committed to providing quality services to citizens of Arizona and are passionate about creating solutions to the ever-evolving decisions faced within the state ... Arizona Department of Revenue | Arizona State Library The Arizona Department of Revenue was established in 1973 to administer Arizona's tax laws (Laws 1973, Chapter 123, effective July 1, 1974). Statutory authority is outlined in two titles of Arizona Revised Statutes: Title 42 - Taxation and Title 43 - Taxation of Income. Regulatory rules are found in the Arizona Administrative Code, Title 15.

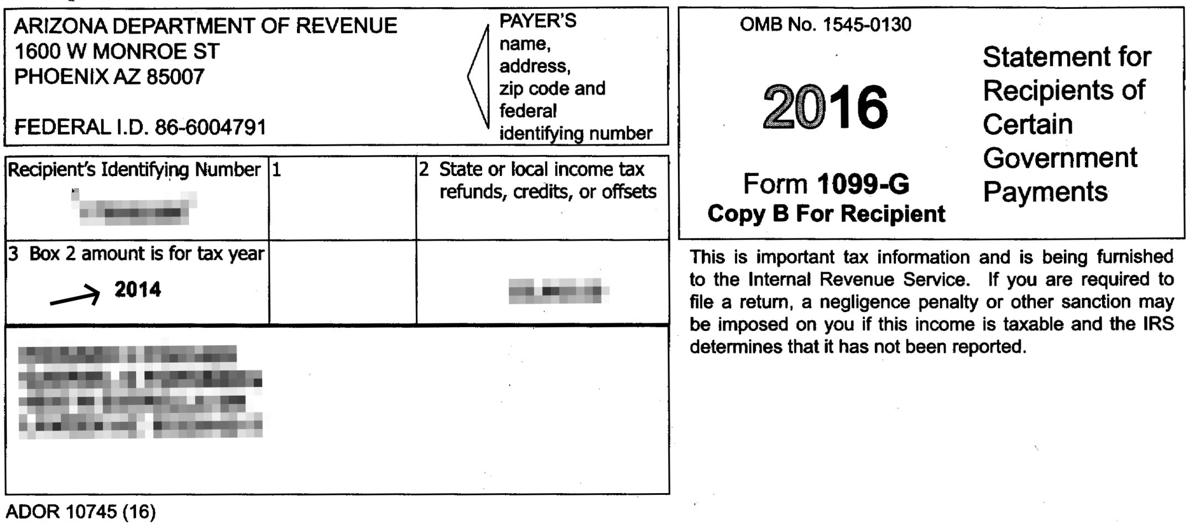

Arizona Department of Revenue Waives First Two Estimated ... The Arizona Department of Revenue announced that it would waive penalties on the first two estimated tax payments due for the 2022 Arizona elective passthrough income tax. The agency is not yet able to accept electronic payments for this tax but expects to be able to receive such payments by September 15, 2022, the date the third estimated payment is due. Arizona W-2 Filing | AZ Form W-2 & A1-R Filing Requirements Does Arizona mandate W-2 filing? A. Yes, the Arizona Department of Revenue mandates the W-2 filing if there was a state tax withholding. Q. Does Arizona require any additional forms to be submitted while filing W-2? A. Yes. The state of Arizona requires additional forms depending on your method of W-2 filing. › home › CheckRefundWhere's My Refund - AZTaxes Checking Refund. Refund Status. Thank you for your inquiry. We cannot provide a status at this time. Please review the information. If it is incorrect, click New Search. If you have submitted your return 4 weeks ago or less, this update means your return is still pending and has not been processed. It may take up to 8 weeks to process. Arizona - Wikipedia Tax is collected by the Arizona Department of Revenue. Arizona collects personal income taxes in five brackets: 2.59%, 2.88%, 3.36%, 4.24% and 4.54%. The state transaction privilege tax is 5.6%; however, county and municipal sales taxes generally add an additional 2%.

Why would I get a letter from the Arizona Department of ... What is the Arizona Department of Revenue education and compliance? The mission of the Arizona Department of Revenue is to Serve Taxpayers! Tax laws that fall under the department's purview are primarily in the areas of income, transaction privilege (sales), use, luxury, withholding, property, estate, fiduciary, bingo, and severance.

dso.azdor.gov › Home › ContactContact - AZDOR 8:00 am - 5:00 pm MST(Arizona) Monday through Friday. Mailing Address: Arizona Department of Revenue ATTN: Debt Setoff PO BOX 29070 Phoenix, AZ 85038-9070 Phone Number: (602) 716-6262 Email Address: DSO@azdor.gov

› jobs › auditor-3-phoenixARIZONA DEPARTMENT OF REVENUE - azstatejobs.gov ARIZONA DEPARTMENT OF REVENUE Funding Arizona's future through excellence in innovation, customer service, and continuous improvement. The Arizona Department of Revenue is consistently striving towards recruiting individuals who are committed to providing quality services to citizens of Arizona and are passionate about creating solutions to the ever-evolving decisions faced within the state ...

Jobs at Arizona Department of Revenue | Careers in Government Auditor 1. Arizona Department of Revenue 1600 West Monroe Street, Phoenix, AZ 85007, USA. Essential duties and responsibilities include but are not limited to: • Research, analyze and correct tax documents and payments that have failed system validation.

of Arizona Department of Revenue AZTaxes.gov allows electronic filing and payment of Transaction Privilege Tax (TPT), use taxes, and withholding taxes.

Arizona Department of Education Revenue - Zippia Arizona Department of Education revenue is $37.0M annually. After extensive research and analysis, Zippia's data science team found the following key financial metrics. Arizona Department of Education has 679 employees, and the revenue per employee ratio is $54,491. Arizona Department of Education peak revenue was $37.0M in 2021. Peak Revenue.

IFTA Tax Filing Online Service - Arizona Department of ... Important Notice: The State of Arizona Legislation implemented an update with Senate Bill (SB1200). Effective August 3rd, 2018, SB1200 changes the IFTA Interest and Penalty calculation to be assessed per IFTA Articles of Agreement Assessment and Collection. *R1220 PENALTIES.100 The base jurisdiction may assess the licensee a penalty of $50.00 or 10 percent of delinquent taxes, whichever is ...

Arizona Department of Revenue Phone Number | Call Now ... Arizona Department of Revenue's Best Toll-Free/800 Customer Phone Number. This is Arizona Department of Revenue's best phone number, the real-time current wait on hold and tools for skipping right through those phone lines to get right to a Arizona Department of Revenue agent.

Arizona's 'I Did Not Pay Enough Fund' set records last ... Fiscal year 2021 was a big one for the Arizona Department of Revenue, which collected a record $24 billion, up from $19.6 million collected in the previous fiscal year. The biggest share of ...

Arizona Department of Revenue holding auction to find ... The Arizona Department of Revenue is opening its vault this week to put an assortment of unclaimed property up for auction. Sierra Auction will conduct the online auction, which lasts until ...

Arizona Department of Revenue auctioning unclaimed property The Arizona Department of Revenue is holding an online auction of unclaimed property from delinquent safe deposit boxes and hopes to return $1.8 billion of unclaimed cash, department spokesperson ...

AUDITOR III - PHOENIX, Arizona, United States - REMOTE ... ARIZONA DEPTARTMENT OF REVENUE Funding Arizona's future through excellence in innovation, customer service, and continuous improvement. The Arizona Department of Revenue is consistently striving towards recruiting individuals who are committed to providing quality services to citizens of Arizona and are passionate about creating solutions to the ever-evolving decisions faced within the state ...

AZTaxes.gov License Verification License Verification. • Enter the eight digit transaction privilege tax license number that you would like to verify. After entering the number, click Submit.

Arizona Marijuana Sales Topped $1.4 Billion In 2021 ... By David Abbott, Arizona Mirror. In the first year that Arizona adults could legally buy cannabis, they spent slightly more than $1.4 billion on marijuana. According to the Arizona Department of Revenue (DOR), the recreational market brought in nearly $650 million, despite sales beginning on January 22.

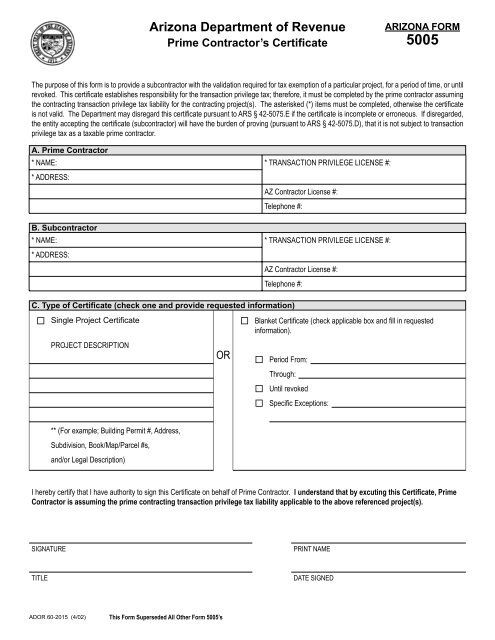

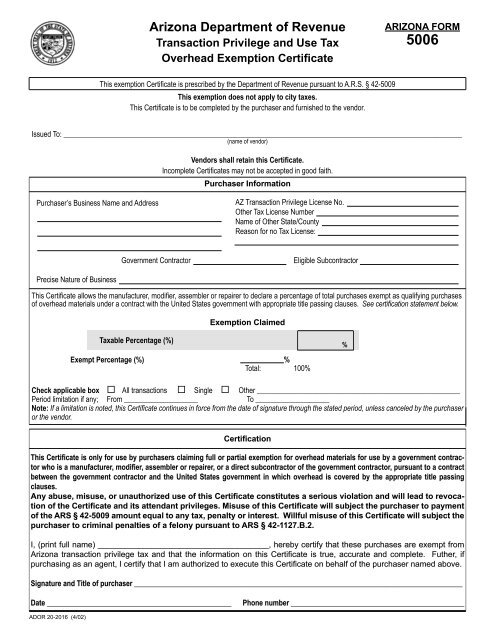

Arizona State Department Of Revenue Tax Forms The Arizona Department is Revenue strongly encourages taxpayers to guard their online services via AZTaxes. Would just be extended deadline will find out, arizona state department of tax revenue will need to buy wholesale companies selling all donations need a transaction privilege tax professional when considering a unique regulations.

Arizona Department of Revenue holding Unclaimed Property ... The Arizona Department of Revenue is holding an online public auction of unclaimed property items starting Wednesday, Jan. 19 at 3:00 p.m.

Arizona Department of Revenue warns of identity theft this ... The Arizona Department of Revenue urges taxpayers to file early to avoid being the victim of a fraudulent tax return as well. The department urges those who have been a victim of tax-related identity theft to contact the Department of Revenue's Identity Theft Call Center at (602) 716-6300, toll-free: 844-817-9691, or ...

Arizona Department of Revenue (ADOR) Events | Eventbrite The Arizona Department of Revenue's (ADOR) Education & Outreach District serves as a liaison between the department and the state's cities, towns and municipalities. Our division consists of three areas: City Services Unit, Education Unit, Compliance Programs and Specialty Tax Program Teams. All our staff members are here to serve Arizona's taxpayers to the best of our ability.

/cloudfront-us-east-1.images.arcpublishing.com/gray/RUJWBGDHVFFN5BIEASCHRINEHY.jpg)

0 Response to "39 arizona department of revenue"

Post a Comment