43 deferred revenue asset or liability

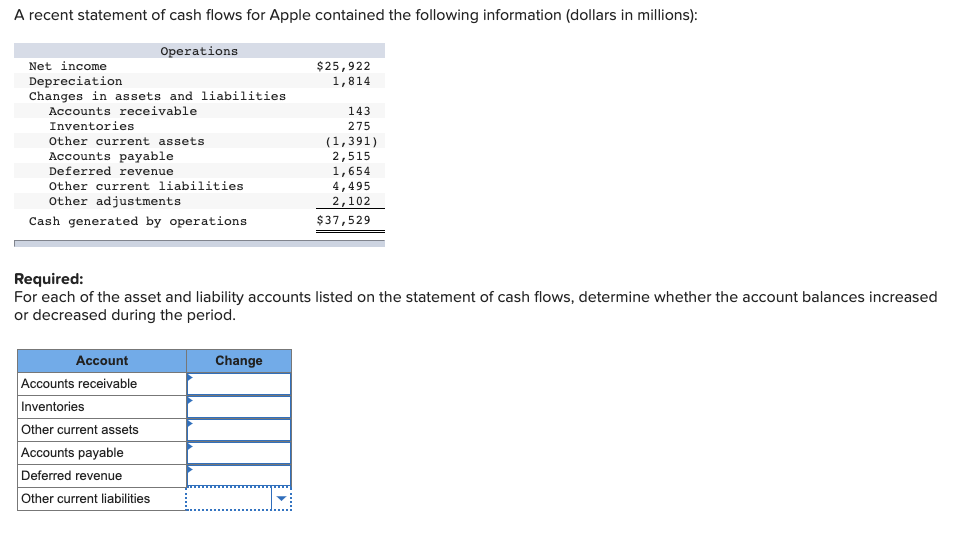

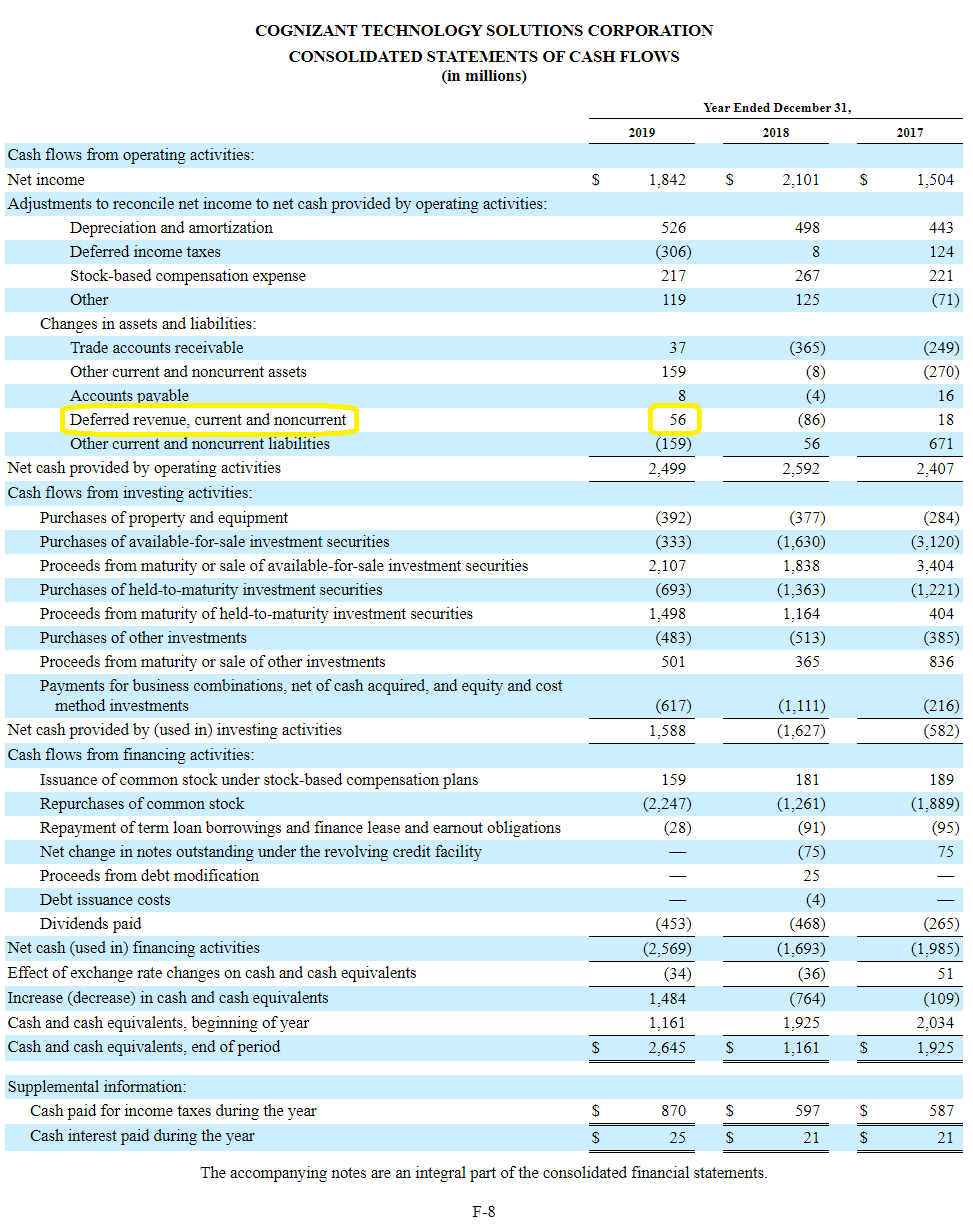

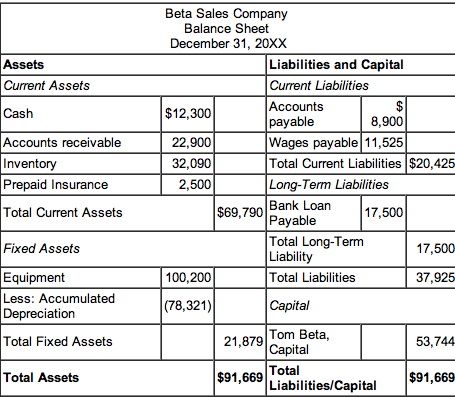

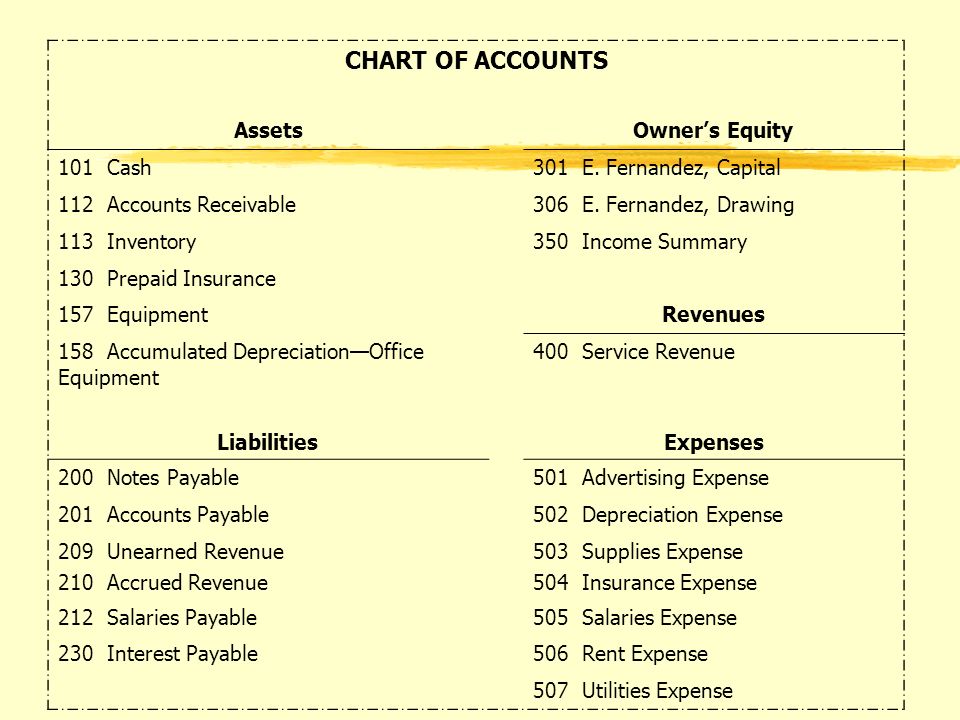

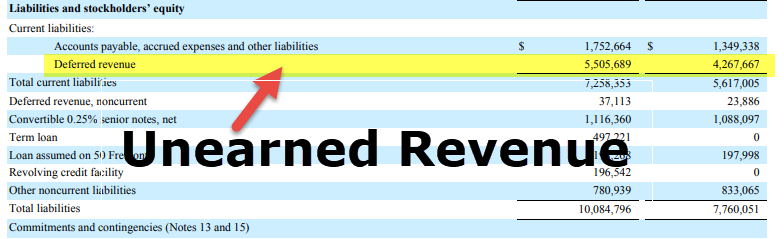

Deferred Revenue: U.S. GAAP Liability Definition Deferred Revenue — Liability Treatment. Following the standards established by U.S. GAAP, deferred revenue is treated as a liability on the balance sheet since the revenue recognition requirements are incomplete. Typically, deferred revenue is listed as a "current" liability on the balance sheet due to prepayment terms ordinarily lasting ... Answered: An entity shall offset a deferred tax… | bartleby Answered: An entity shall offset a deferred tax… | bartleby. An entity shall offset a deferred tax asset and deferred tax liability A. When income taxes are levied by the same taxing authority B. Expected future tax law regardless of whether enacted or not C. Under all circumstances D. Choices A and B are correct.

› knowledge-center › the-differenceWhat Is the Difference Between Deferred Revenue and Unearned ... Nov 28, 2018 · Gradually, that revenue will shift from a liability to an asset as the company fulfills its obligations. Service providers are another example of businesses that typically deal with deferred revenue.

Deferred revenue asset or liability

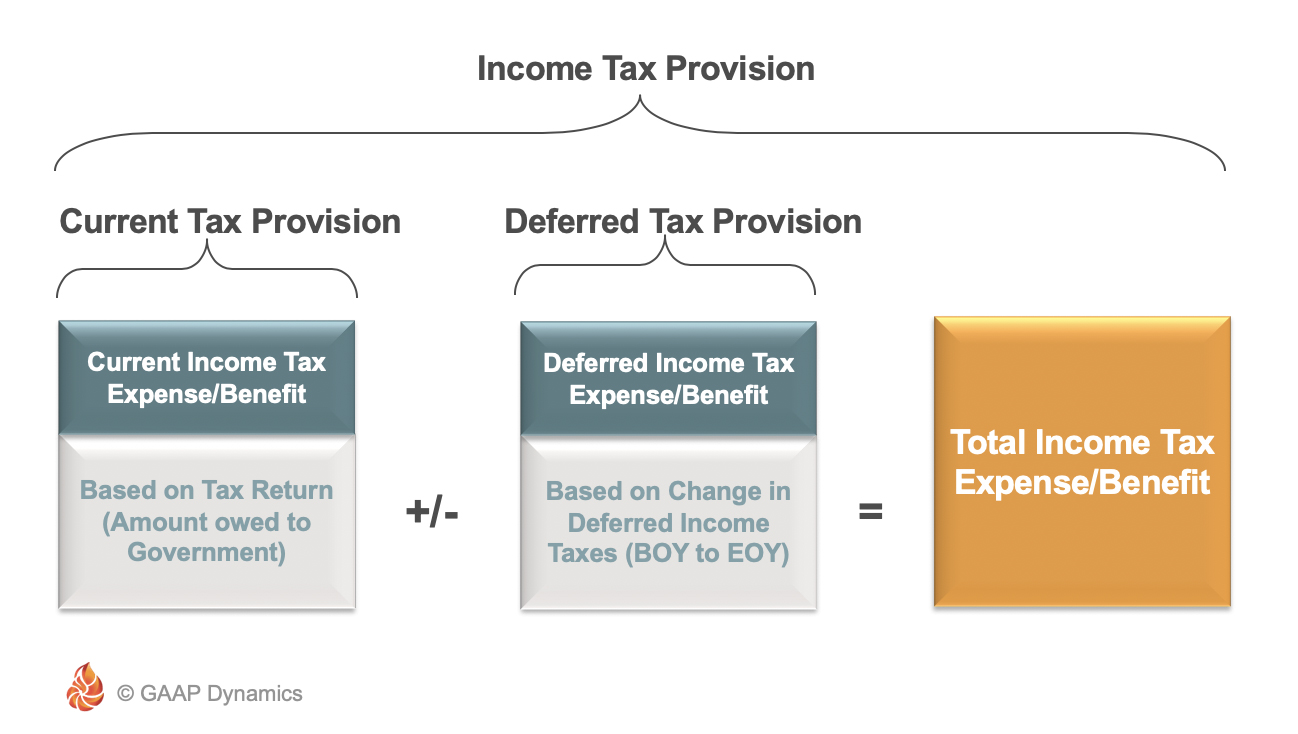

Is Deferred rent an asset? - FindAnyAnswer.com Deferred rent is defined as the liability that is created as a result of the difference between the actual cash paid and the straight-line expense recorded on the financial statements. Also Know, is Deferred rent a current or long term liability? Deferred Revenue Expenditure: Meaning and Examples In business, Deferred Revenue Expenditure is an expense which is incurred while accounting period. And the result and benefits of this expenditure are obtained over the multiple years in the future. For example, revenue used for advertisement is deferred revenue expenditure because it will keep showing its benefits over the period of two to three years. What are Deferred Tax Assets and Liabilities? Deferred tax assets and liabilities both represent an amount of money that is owed in two different ways: deferred tax assets are owed to the company, while deferred tax liability is owed to the government Depreciation is the one common point between deferred tax assets and liabilities that creates discrepancies in tax and accounting calculations.

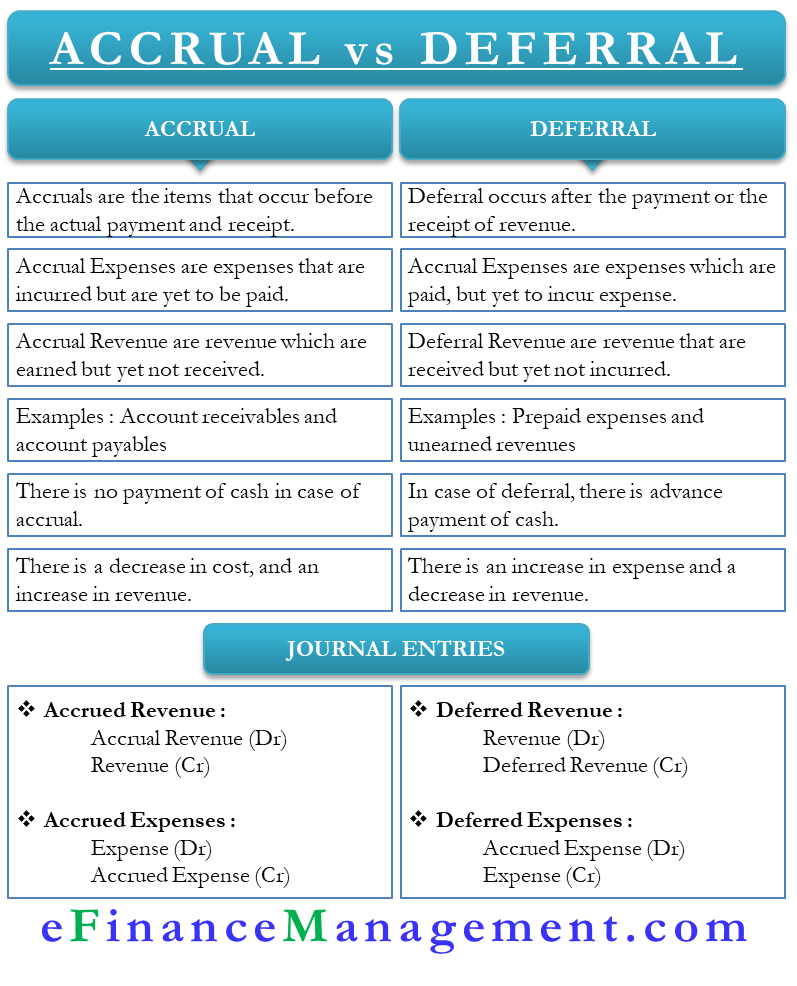

Deferred revenue asset or liability. › recur › allWhat is deferred revenue? Is it a liability & accounting for it Why is deferred revenue considered a liability? Businesses and accountants record deferred revenue as a liability (a balance sheet credit entry) because it represents products and services you owe your customers—for example, an annual subscription for SaaS software, a retainer for legal services, or a hotel booking fee. Is Service Revenue Asset or Liability + How to Calculate It When this occurs, it's typically recorded as a credit to the income statement and an asset account called deferred expenses. On the other hand, when these types of revenues are billed after work has been completed, they are usually recorded as a debit to the income statement. Is service revenue on a balance Sheet? Absolutely. Classification of Deferred Outflows/Inflows of Resources ... 3.5.1.60 GASB expressly reserved for itself the determination of which items traditionally reported as assets or liabilities should be reclassified as deferred outflows or inflows of resources. The use of the term deferred should be limited to items reported as deferred outflows or inflows of resources. Why is accrued revenue (unlike deferred revenue) an asset ... Deferred revenue is like accounts payable; you are given something without giving something back in exchange. You have a liability on your hands until you give the other party what you owe them. In the case of deferred revenue for rent for example, you receive money, but you have not given the other party the service of rent.

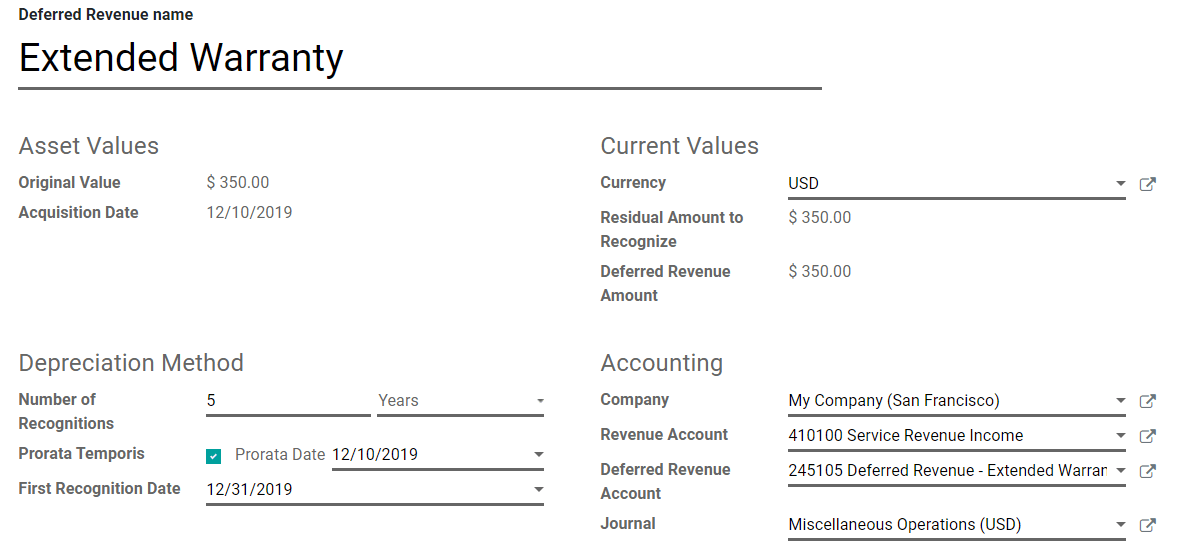

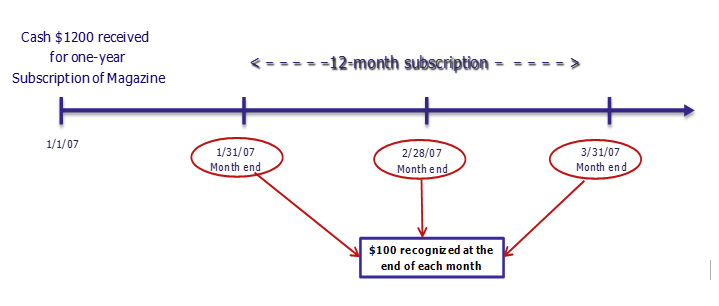

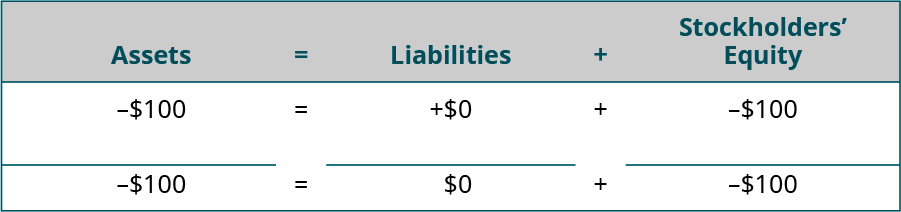

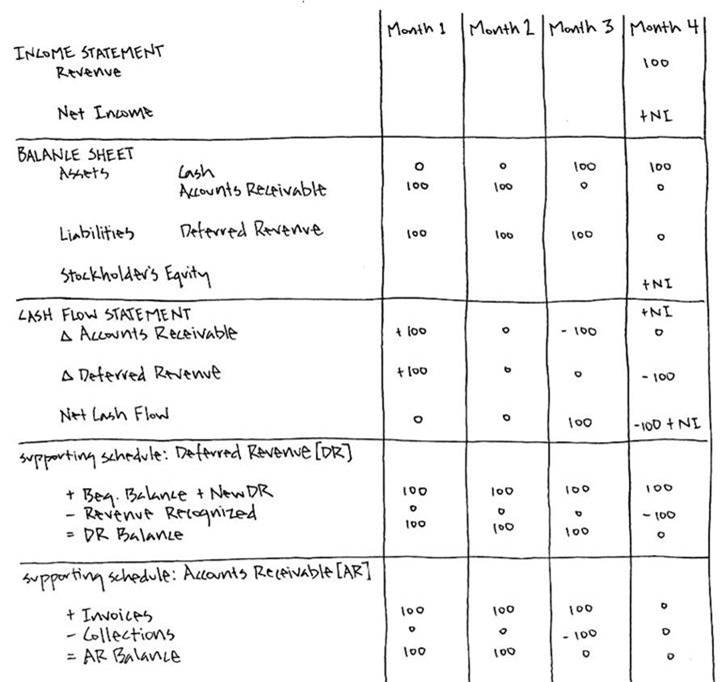

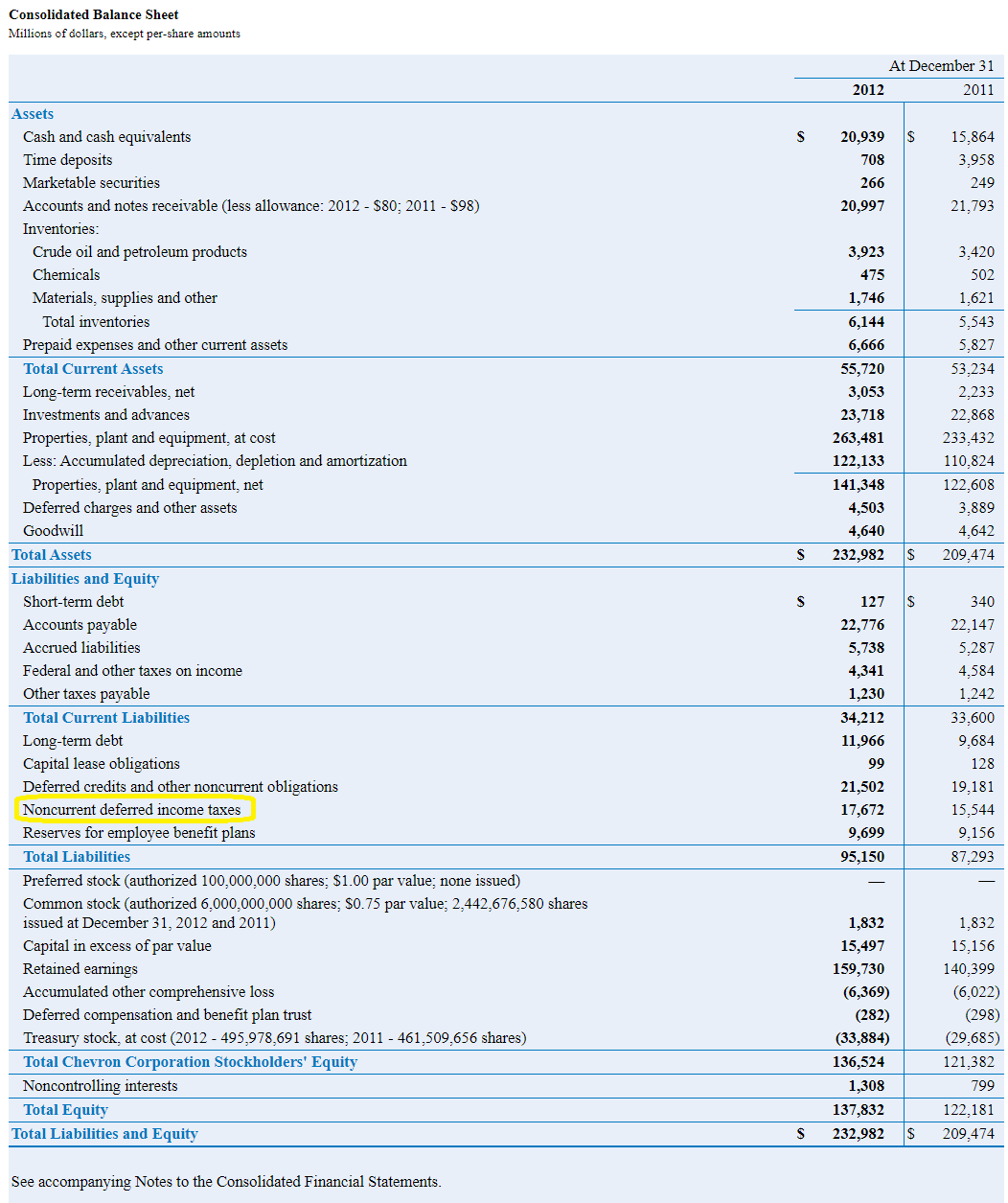

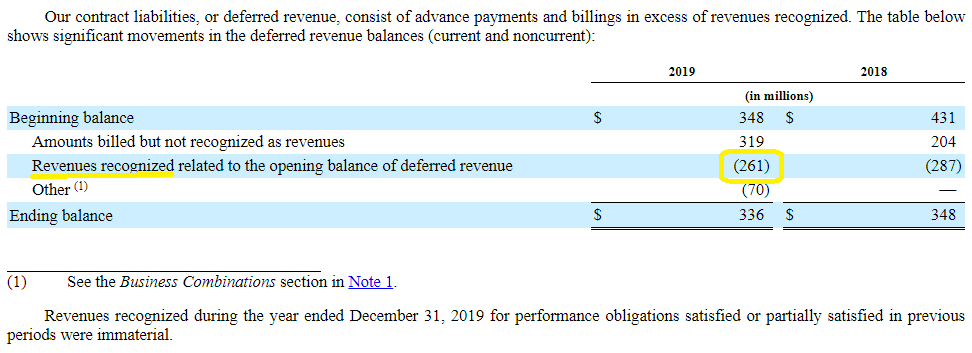

› Account-For-Deferred-RevenueHow to Account For Deferred Revenue: 6 Steps (with Pictures) Mar 04, 2021 · The company receives cash (an asset account on the balance sheet) and records deferred revenue (a liability account on the balance sheet). X Research source In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription. Deferred Tax Liability (or Asset) - How It's Created in ... A deferred tax liability or asset is created when there are temporary differences between book tax and actual income tax. There are numerous types of transactions that can create temporary differences between pre-tax book income and taxable income, thus creating deferred tax assets or liabilities. Deferred Revenue - Understand Deferred Revenues in Accounting On the balance sheet, cash would be unaffected, and the deferred revenue liability would be reduced by $100. The pattern of recognizing $100 in revenue would repeat each month until the end of 12 months, when total revenue recognized over the period is $1,200, retained earnings are $1,200, and cash is $1,200. Is Deferred revenue a contract liability? Deferred revenue is included as a liability because goods have not been received by the customer or the company has not performed the contracted service even though money has been collected. Deferred revenue is classified as either a current liability or a long-term liability. Additionally, what is an example of a deferred revenue?

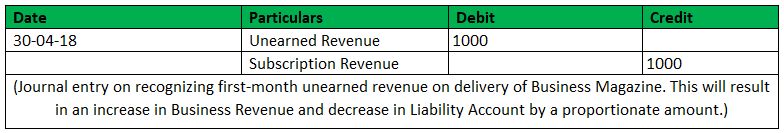

Is Deferred income an asset? - AskingLot.com Deferred revenue refers to payments received in advance for services which have not yet been performed or goods which have not yet been delivered. These revenues are classified on the company's balance sheet as a liability and not as an asset. Click to see full answer. Also asked, what is deferred income on balance sheet? Deferred Revenue (Definition)| Accounting for Deferred Income Thus, the Company reports it as a deferred revenue a liability than an asset until the time it delivers the products and services. It is also called as unearned revenue or deferred income. Examples A good example is that of a magazine subscription business where this revenue is a part of the business. Demystifying deferred tax accounting: PwC A deferred tax often represents the mathematical difference between the book carrying value (i.e., an amount recorded in the accounting balance sheet for an asset or liability) and a corresponding tax basis (determined under the tax laws of that jurisdiction) in the asset or liability, multiplied by the applicable jurisdiction's statutory ... Deferred Revenue, Basic Accounting Transactions, Financial ... Deferred revenue is sometimes called unearned revenue, and it is through the use of this term that I believe it makes it easier to understand why it is initially a liability but is later transferred to an asset item. One of the most basic concepts of accounting involves determining if an item is an asset or a liability. Cash is an asset.

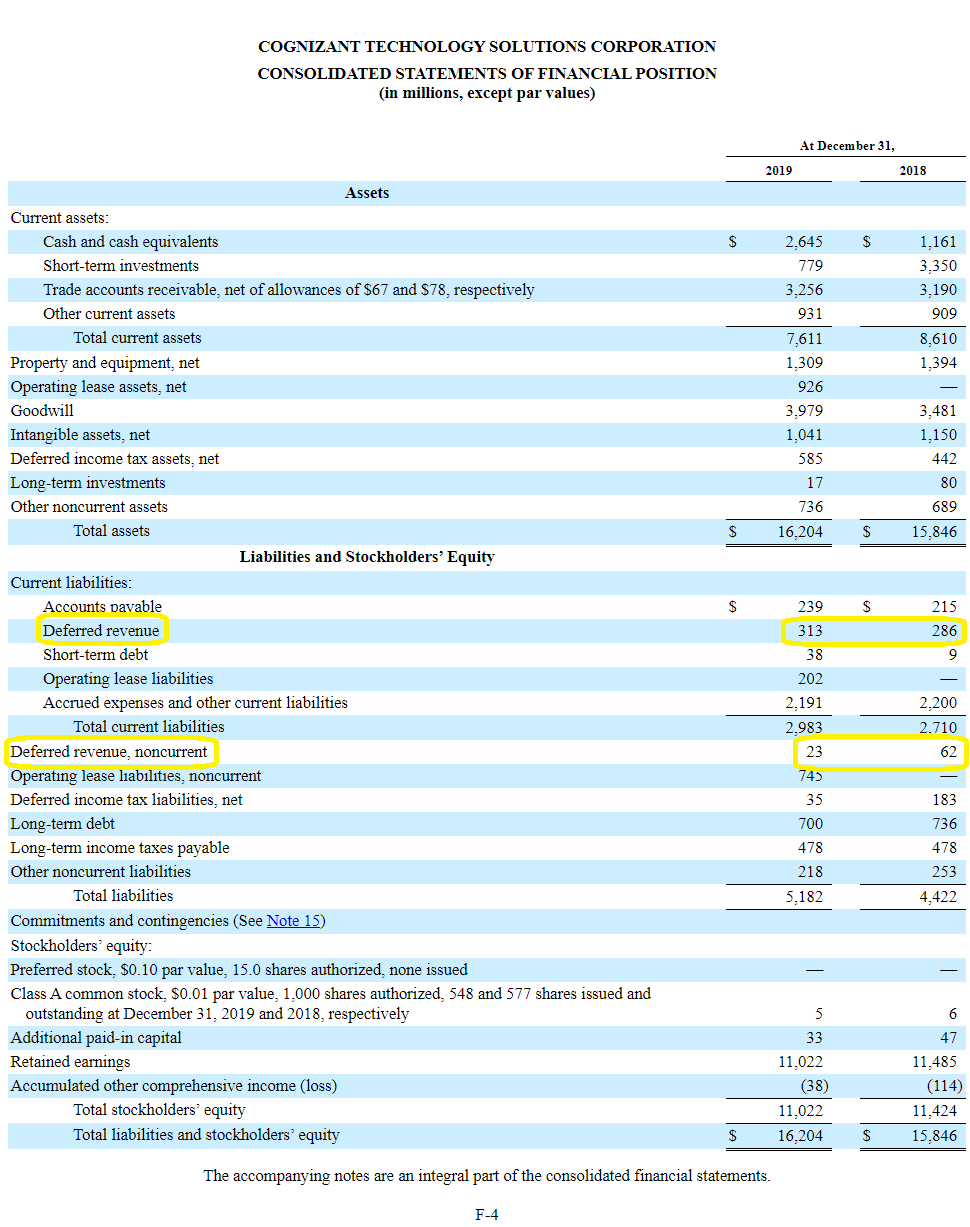

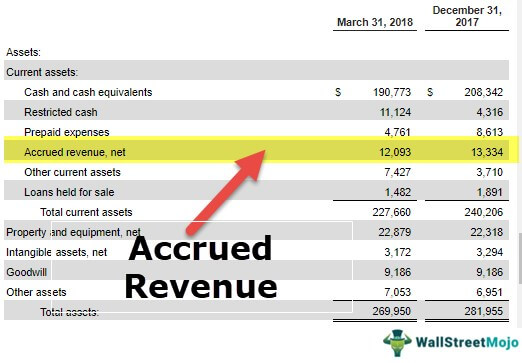

Is Deferred Revenue a Liability? - Baremetrics Deferred revenue shows up in two places on the balance sheet. First, since you have received cash from your clients, it appears as part of the cash and cash equivalents, which is an asset. However, since you have not yet earned the revenue, deferred revenue is shown as a liability to indicate that you still owe the client your services.

Why is Deferred Revenue Treated as a Liability? Deferred revenue, which is also referred to as unearned revenue, is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been...

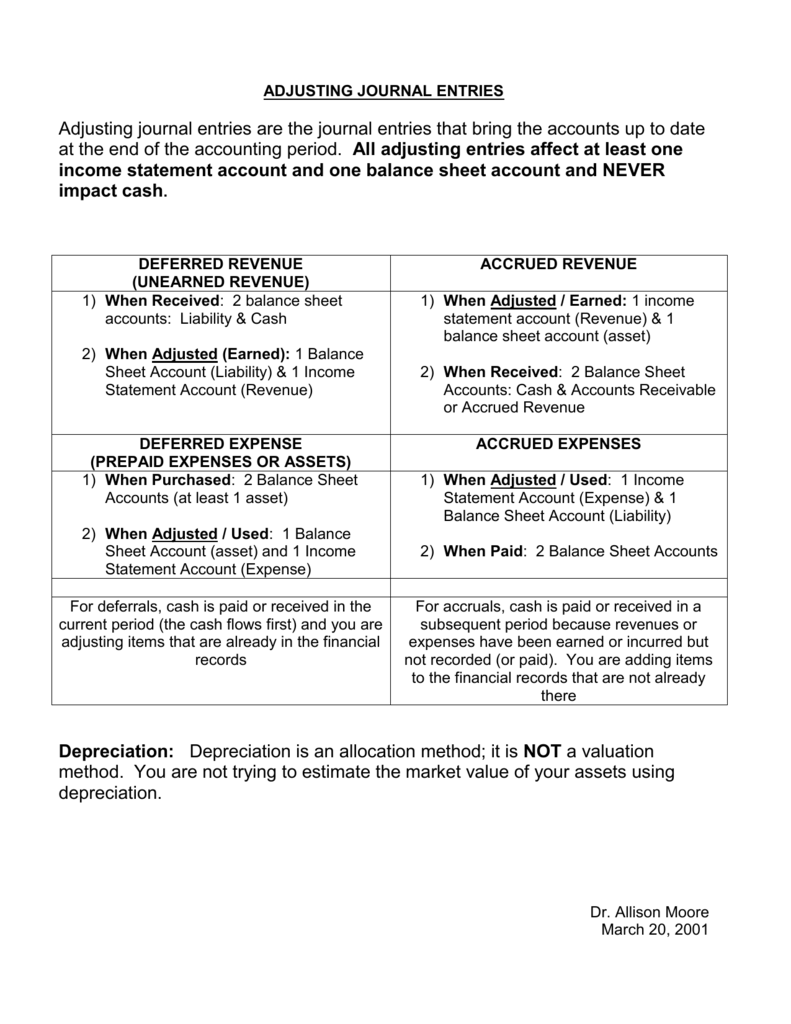

Accounting 101: Deferred Revenue and Expenses - Anders CPA Why is deferred revenue considered a liability? Because it is technically for goods or services still owed to your customers. Accounting for Deferred Expenses Like deferred revenues, deferred expenses are not reported on the income statement. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred.

Is deferred revenue a liability? - Accounting Capital The concept of deferred revenue applies only if an entity follows the Accrual System of Accounting. If the entity follows the cash system of accounting it's of no relevance as the entire amount received becomes income in the year of receipt. Whether the Deferred Revenue is a Liability? The answer to this question is "Yes" it is a liability.

Where Did the Deferred Revenue Go in Your Acquisition ... Why Deferred Value Changes in a Deal. What does happen to deferred revenue during a transaction? Under purchase price accounting rules, assets and liabilities acquired as part of a business must be revalued at their fair value as of the acquisition date. For most assets and liabilities, this is a straightforward process.

Details for Repair Revenue Asset Or Liability and Related ... Is Deferred Income an Asset or a Liability? On a company's balance sheet, deferred revenue is a liability because it represents an obligation to a customer (i.e. the customer has prepaid for goods and services). More › 238 People Used More Info ›› Visit site Capital and Revenue Expenditure | Accounting Hub new

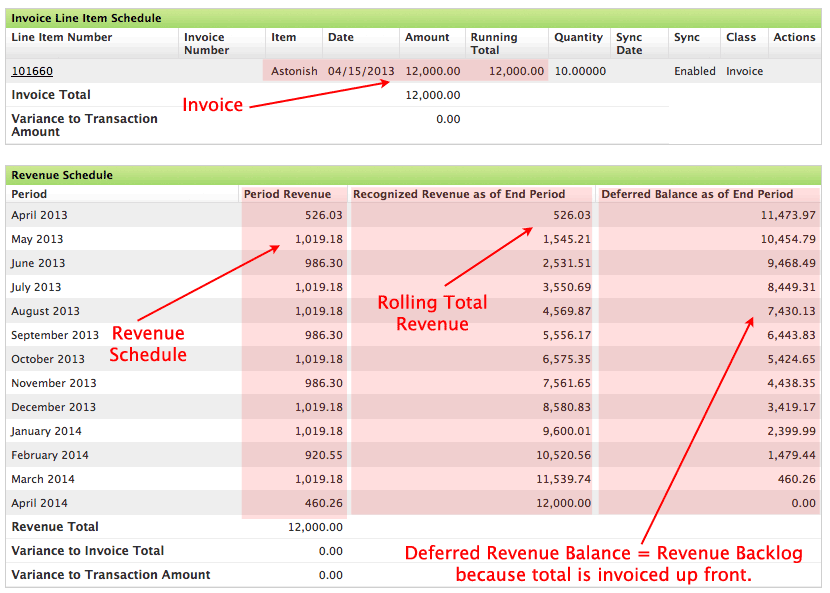

saascfoservices.com › what-are-deferred-revenueWhat are Deferred Revenue and Unbilled Revenue? - SaaS CFO ... Aug 25, 2020 · Deferred Revenue is a liability on the Balance Sheet. It represents a future obligation. Performance of this obligation leads to recognition of revenue and the reduction of the liability. Most SaaS companies send invoices in advance of providing their service (e.g., you invoice for an entire year). Thus, most SaaS companies will have Deferred ...

Is Deferred income a current liability? - AskingLot.com Deferred revenue is included as a liability because goods have not been received by the customer or the company has not performed the contracted service even though money has been collected. Deferred revenue is classified as either a current liability or a long-term liability. Click to see full answer.

Deferred Revenue Definition - Investopedia Deferred revenue is a liability because it reflects revenue that has not been earned and represents products or services that are owed to a customer. As the product or service is delivered over...

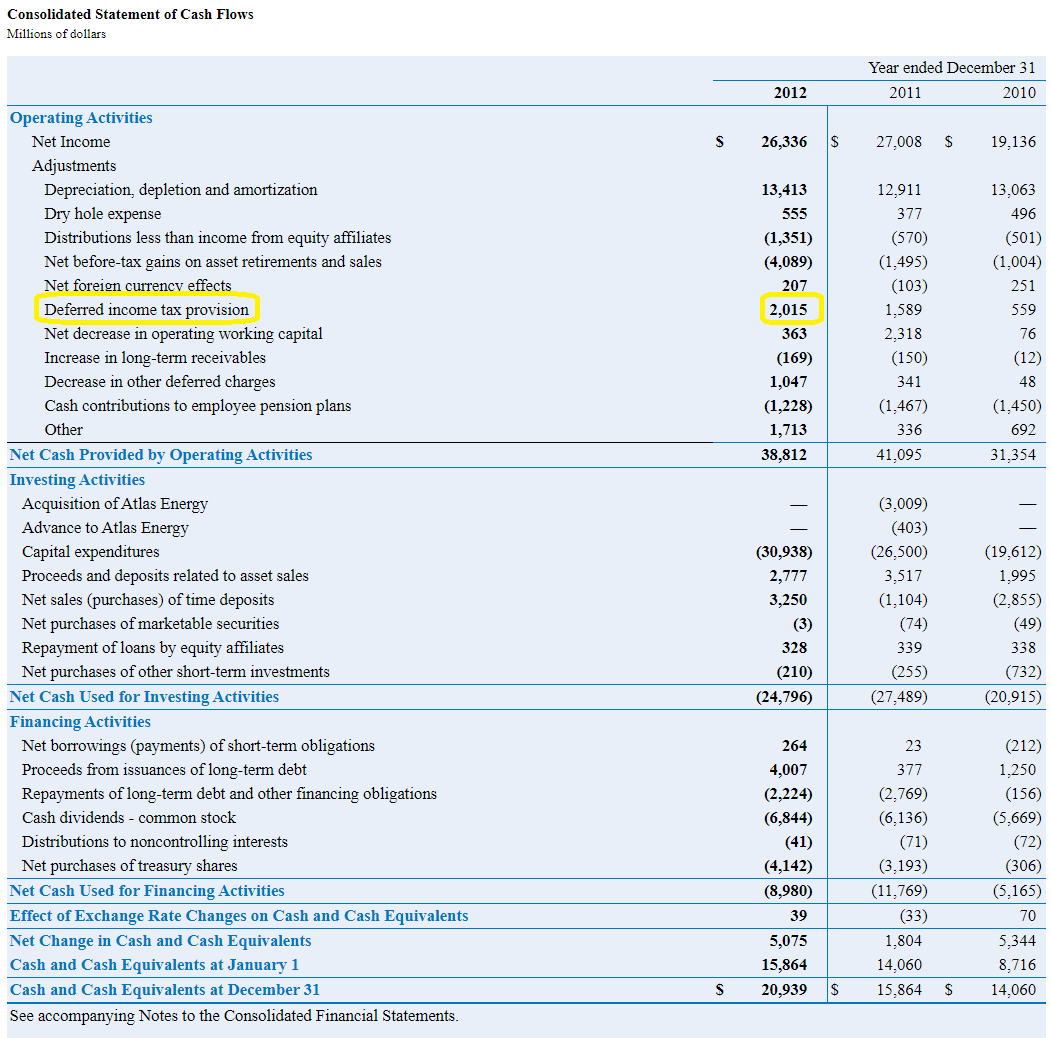

› how-to-calculate-deferredHow to calculate Deferred Tax Asset / Liability AS-22 Nov 21, 2016 · So deferred tax asset is created, which is adjusted with the deferred tax liability of last year. The balance of Rs. 291,000 will be charged back in profit and loss account under tax expenses and Rs. 3,09,000 will be shown as deferred tax asset under non-current assets. Method 2: By Computing differences in WDV as per IT and companies act.

Deferred Tax Liabilities | Deferred Tax Liability vs ... Deferred tax liability (DTL) is the temporary difference between the actual profit and the booked profits (profits determined as per GAAP and as per income tax laws). There are certain P&L items that create this difference which may be either permanent difference or timing difference. The permanent difference does not lead to the creation of DTL.

snov.io › glossary › deferred-revenueWhat is Deferred Revenue: Definition, examples, importance ... May 05, 2021 · Is deferred revenue a liability? Yes, deferred revenue is a liability and not an asset. The payment the company gets represents something owed to the customer. Deferred revenue examples. All companies selling products or providing services that require prepayments deal with deferred revenue. Here are some examples: Advance rent; Mobile service ...

What Is The Difference Between Deferred Revenue And ... An excellent example of a business that deals with deferred revenue is one that sells subscriptions. Gradually, that revenue will shift from a liability to an asset as the company fulfills its obligations. 9In practice, the unearned revenue balance is commonly used to estimate a buyer's future cost.

› sales › deferredDeferred Revenue Journal Entry - Double Entry Bookkeeping Aug 09, 2019 · In this case one asset (accounts receivable) increases representing money owed by the customer, this increase is balanced by the increase in liabilities (deferred revenue account). The credit to the deferred revenue account represents a liability as the service still needs to be provided to the customer. Deferred Revenue Recognition. Deferred ...

What are Deferred Tax Assets and Liabilities? Deferred tax assets and liabilities both represent an amount of money that is owed in two different ways: deferred tax assets are owed to the company, while deferred tax liability is owed to the government Depreciation is the one common point between deferred tax assets and liabilities that creates discrepancies in tax and accounting calculations.

Deferred Revenue Expenditure: Meaning and Examples In business, Deferred Revenue Expenditure is an expense which is incurred while accounting period. And the result and benefits of this expenditure are obtained over the multiple years in the future. For example, revenue used for advertisement is deferred revenue expenditure because it will keep showing its benefits over the period of two to three years.

Is Deferred rent an asset? - FindAnyAnswer.com Deferred rent is defined as the liability that is created as a result of the difference between the actual cash paid and the straight-line expense recorded on the financial statements. Also Know, is Deferred rent a current or long term liability?

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-07-31at3.56.40PM-f53c6447715749d79f242c0a0759fbb5.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

![Problem 12 [DTD-deferred revenue-inverted] ABC's tax | Chegg.com](https://media.cheggcdn.com/media/b8d/b8d8d50b-6f7b-4c1e-bf67-13ad15f95187/php8tls0U)

![Problem 12 [DTD-deferred revenue-inverted] ABC's tax | Chegg.com](https://media.cheggcdn.com/media/7c2/7c248eb5-4ecf-4d7d-a559-aecbf16eb11b/phpvju3e0)

0 Response to "43 deferred revenue asset or liability"

Post a Comment