42 pension plan definition

Foreign Pension Plan Definition: 3k Samples | Law Insider Define Foreign Pension Plan. means any plan, fund (including, without limitation, any superannuation fund) or other similar program established or maintained outside the United States of America by the Borrower or any one or more of its Subsidiaries primarily for the benefit of employees of the Borrower or such Subsidiaries residing outside the United States of America, which plan, fund or ... ERISA Pension Plan Definition | Law Insider pension plan means any "employee pension benefit plan" (as such term is defined in section 3 (2) of erisa), other than a multiemployer plan, that is subject to title iv of erisa and is sponsored or maintained by the borrower or any erisa affiliate or to which the borrower or any erisa affiliate contributes or has an obligation to contribute, or …

Definition of Employee Pension Benefit Plan Under ERISA Employee pension benefit plan. (a) General. This section clarifies the limits of the defined terms "employee pension benefit plan" and "pension plan" for purposes of Title I of the Act and this chapter by identifying certain specific plans, funds and programs which do not constitute employee pension benefit plans for those purposes.

Pension plan definition

What does pension plan mean? - definitions Here are all the possible meanings and translations of the word pension plan. Princeton's WordNet (0.00 / 0 votes) Rate this definition: pension plan, pension account, retirement plan, retirement savings plan, retirement savings account, retirement account, retirement program noun a plan for setting aside money to be spent after retirement Defined Benefit Plan | Internal Revenue Service Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more ... › dictionary › pensionPension Definition & Meaning - Merriam-Webster : money paid under given conditions to a person following retirement or to surviving dependents — see also defined benefit plan, defined contribution plan More from Merriam-Webster on pension Thesaurus: All synonyms and antonyms for pension

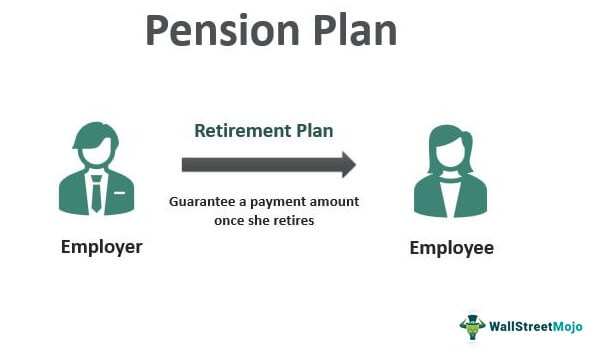

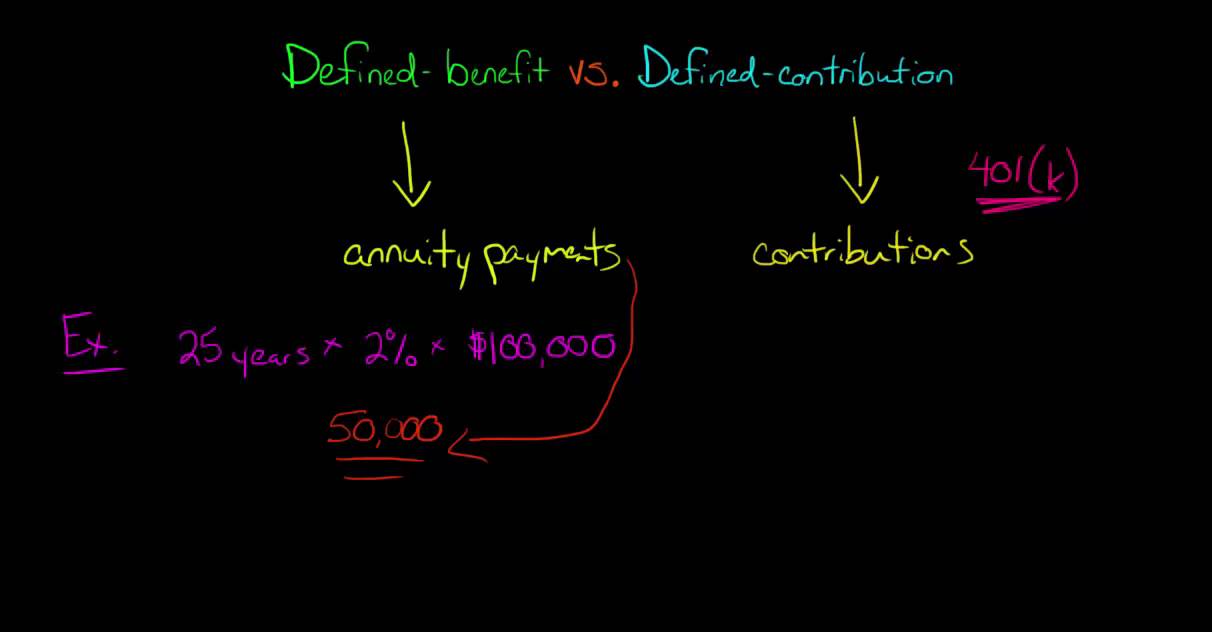

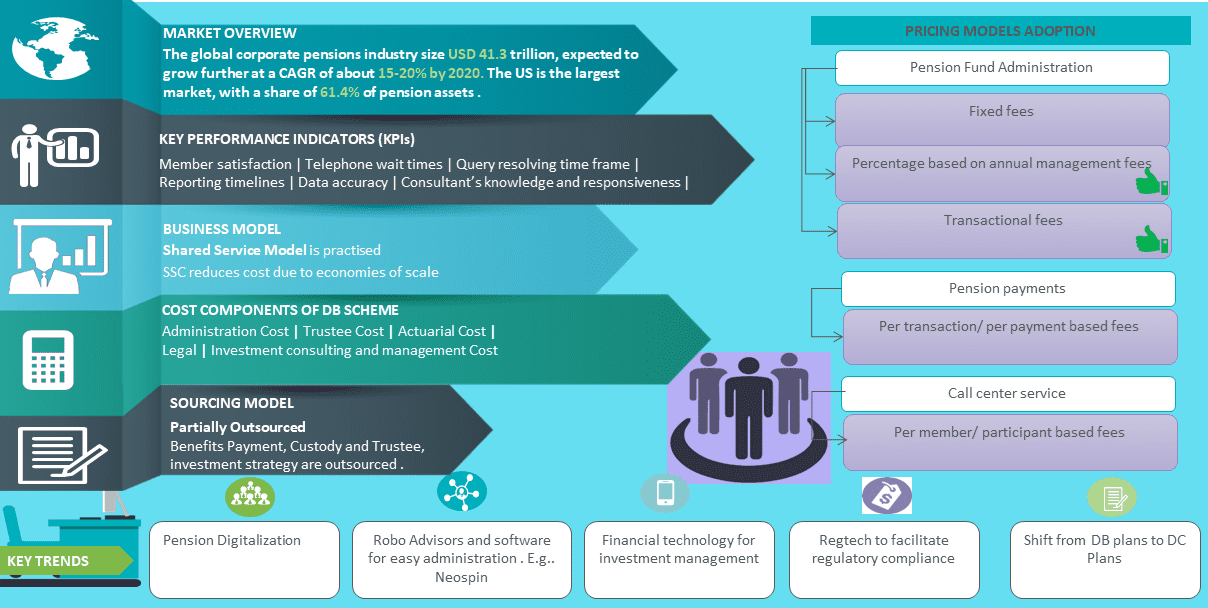

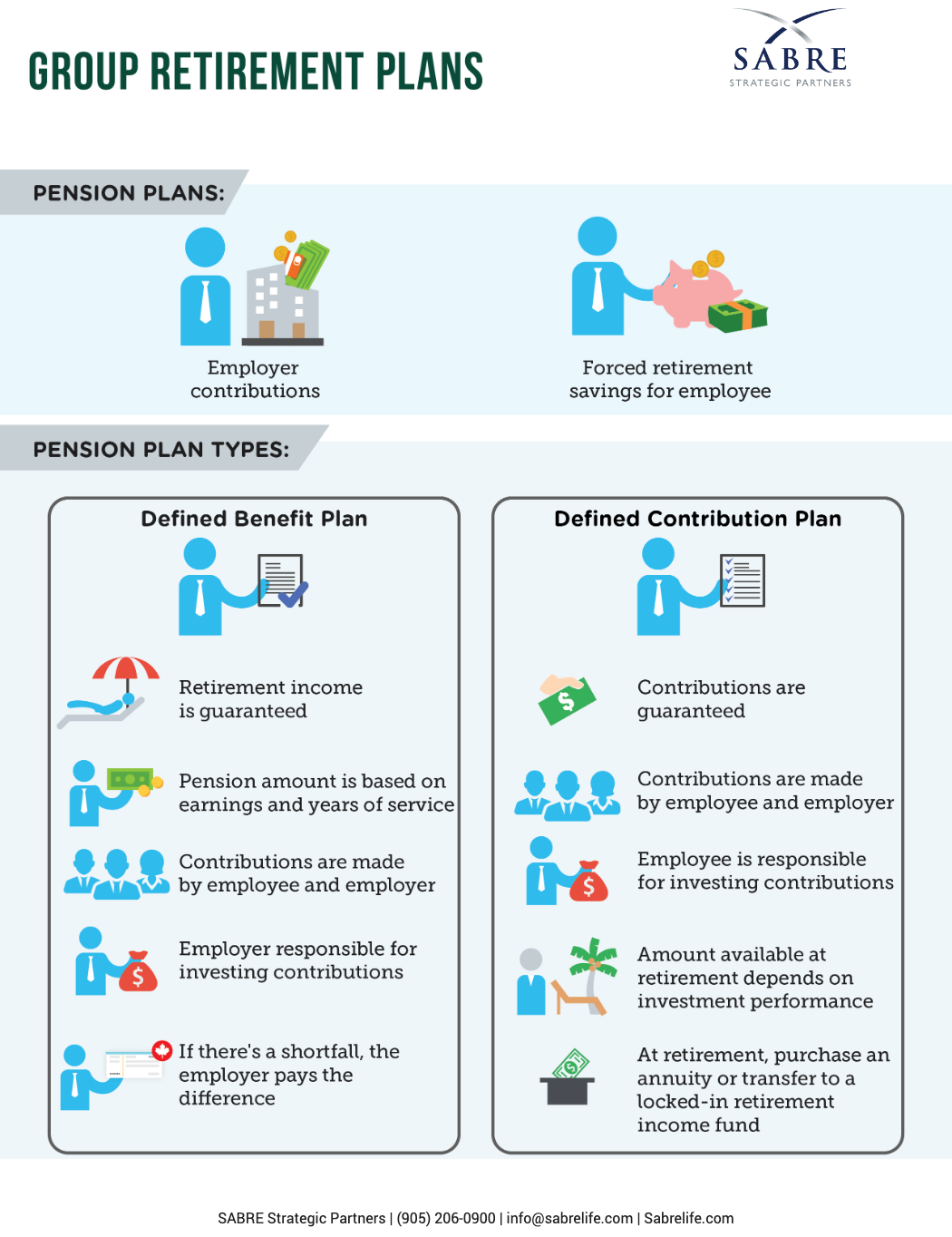

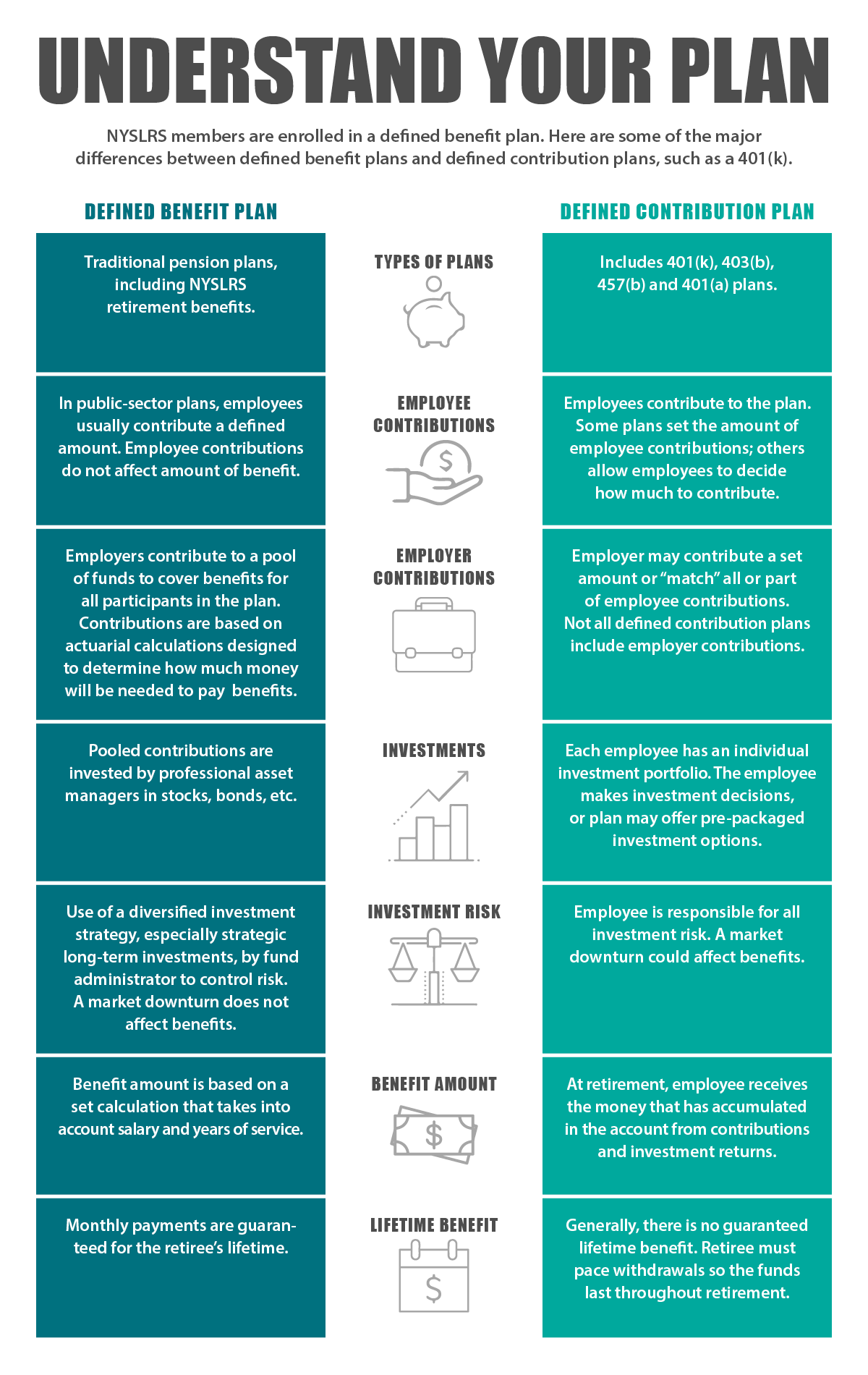

Pension plan definition. What is a Qualified Pension Plan? - Definition from ... There are two main types of qualified pension plans: Defined benefit. Defined contribution. The defined benefit provides employees a guaranteed payout and places the risk on the employers to save and invest to meet the liabilities of the plan. An example of this pension plan is the traditional annuity type of pension. › article › investingPension Plan vs. 401(k): Types, Pros & Cons - NerdWallet Jan 12, 2022 · A pension plan is a retirement-savings plan typically funded by an employer. Money goes into the pension on behalf of the employee while the employee works for the organization. The employee ... What is a Pension Plan? Pension Plan Definition A pension plan is the retirement amount, which an individual gets from their insurance companies on a regular basis or in the form of a lump sum. There are various types of such plans available in Read more Best Pension Options Get Tax Free Pension For Life Flexibility to withdraw fund value any time Guaranteed Tax Savings Under Sec 80 C & 10 (10D) Pension plan financial definition of pension plan A retirement plan in which an employer makes a contribution into an account each month. The contributions are invested on behalf of an employee, who may begin to make withdrawals after retirement. Typically, pensions are tax-deferred, meaning that the employee does not pay taxes on the funds in the pension until he/she begins making withdrawals. Pensions may have defined contributions, defined ...

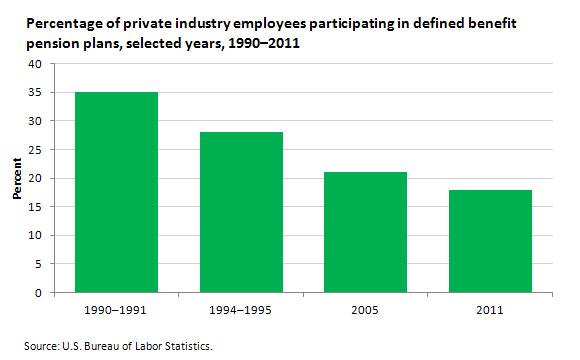

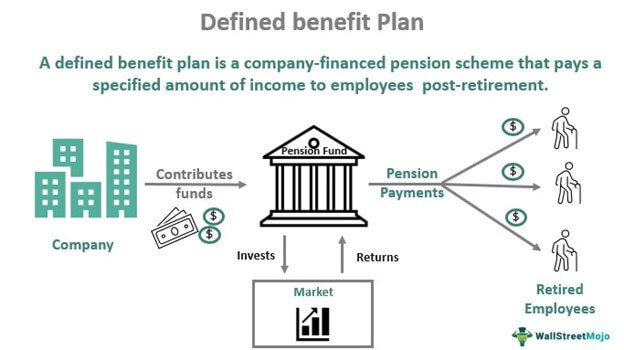

What Is a Pension Plan? - The Balance A pension plan is a type of employer-sponsored retirement plan that pays employees a set income during retirement, usually based on how long they worked for the company. These plans are becoming less common as more employers offer 401 (k) retirement plans. Employers are responsible for funding traditional pension plans. Pension Plan: Definition, Types and How They Work | PointCard A pension plan is a specific benefit offered to employees by their employer. The employer allocates money consistently into a separate fund that workers are eligible to draw from once they retire. In the United States, most people opt for more specialized plans like 401 (k) plans or Roth 401 (k) plans instead of generalized pensions. Pension Fund - Definition, Types, Benefits, How it Works? Pension Fund refers to any fund, plan, or scheme that is set up by an employer (or union) which generates regular income for employees after their retirement. This pooled contribution from the pension plan is usually invested conservatively in government securities, blue-chip stocks, and investment-grade bonds to ensure that it generates sufficient returns. Defined-Benefit Plan A pension plan is an employee benefit that commits the employer to make regular payments to the employee in retirement.

What Is a Defined Benefit Plan? - SmartAsset A defined benefit plan is an employer-provided retirement program that pays employees fixed income payments when they retire. Here's how these plans work. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Closing Costs Calculator en.wikipedia.org › wiki › PensionPension - Wikipedia A defined contribution (DC) plan, is a pension plan where employers set aside a certain proportion (i.e. contributions) of a worker's earnings (such as 5%) in an investment account, and the worker receives this savings and any accumulated investment earnings upon retirement. Pension plan - definition of pension plan by The Free ... Define pension plan. pension plan synonyms, pension plan pronunciation, pension plan translation, English dictionary definition of pension plan. n. An arrangement for paying a pension to an employee, especially one funded fully or in large part by an employer. Pension plan Definition & Meaning - Merriam-Webster Definition of pension plan. : an arrangement made with an employer to pay money to an employee after retirement.

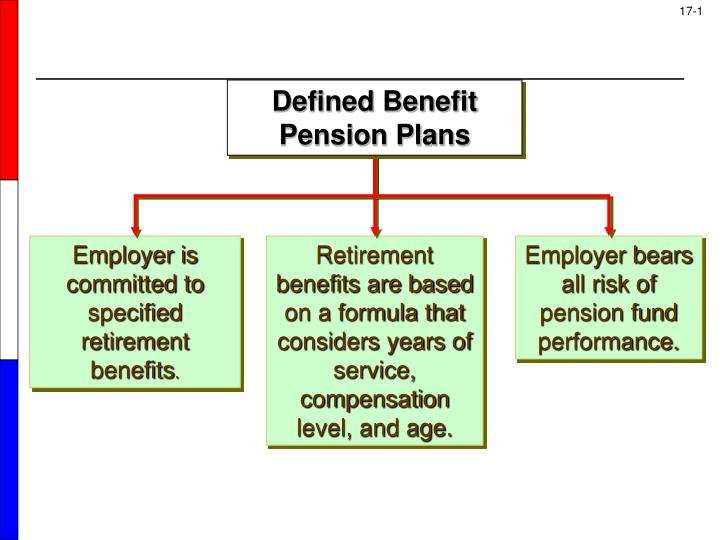

Definition and Example of a Pension - The Balance A pension is a retirement plan that provides a monthly income in retirement. Unlike a 401(k), the employer bears all of the risk and responsibility for funding the plan. A pension is typically based on your years of service, compensation, and age at retirement.

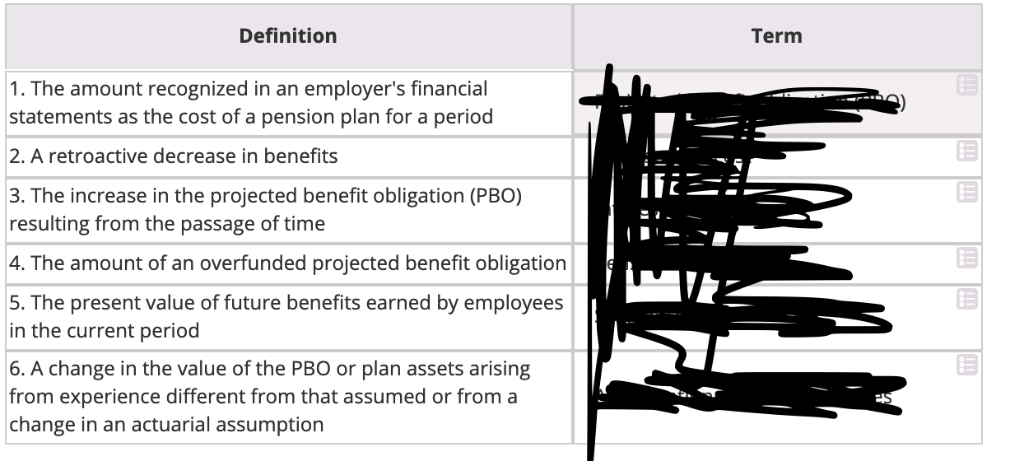

› overfunded_pension_planOverfunded Pension Plan Definition Feb 18, 2021 · An overfunded pension plan is a company retirement plan that has more than enough funds to cover current and future benefits to employees. Pension funds are usually invested in financial ...

Defined-benefit pension legal definition of Defined ... Pension A benefit, usually money, paid regularly to retired employees or their survivors by private businesses and federal, state, and local governments. Employers are not required to establish pension benefits but do so to attract qualified employees. The first pension plan in the United States was created by the American Express Company in 1875.

Pension Plan - Definition, Types, Benefits, 401K vs ... Pension plans are typically set up as a defined benefit plan, meaning an employer will guarantee the employee a payment amount once the employee retires. The payments will be consistent, giving the employee a reliable income stream during retirement. These plans are not the same as 401k, although many people confuse them with one another.

smartasset.com › retirement › what-is-a-pension-planPension Plans: Definition, Types, Benefits & Risks - SmartAsset A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. It's different from a defined contribution plan, like a 401(k), where employees put their own money in an employer-sponsored investment program. Pensions grew in popularity during World War II and became mainstays in benefit packages for government and unionized workers.

Specified Canadian Pension Plan Definition | Law Insider Specified Canadian Pension Plan means any Canadian Pension Plan which contains a "defined benefit provision", as defined in subsection 147.1(1) of the Income Tax Act (Canada). As of the Closing Date and at no time preceding the Closing Date has any Obligor maintained, sponsored, administered, contributed to, or participated in a Specified Canadian Pension Plan .

Defined-benefit pension plan financial definition of ... A pension plan in which retirement benefits rather than contributions into the plan are specified. Thus, a retired employee who has reached a certain age with a given number of years of service and has earned a certain income is entitled to a specific monthly pension payment.

PDF FAQs about Retirement Plans and ERISA - DOL Simplified Employee Pension Plan (SEP) - A plan in which the employer makes contributions on a tax-favored basis to individual retirement accounts (IRAs) owned by the employees. If certain conditions are met, the employer is not subject to the reporting and disclosure requirements of most retirement plans.

› 5 › 14Pension expense definition - AccountingTools Nov 18, 2021 · Pension expense is the amount that a business charges to expense in relation to its liabilities for pensions payable to employees. The amount of this expense varies, depending upon whether the underlying pension is a defined benefit plan or a defined contribution plan. The characteristics of these plan types are noted below. Defined Benefit Plan

Personal pension plan definition and meaning | Collins ... Personal pension plan definition: a private pension scheme in which an individual contributes part of his or her salary to... | Meaning, pronunciation, translations and examples

Types of Retirement Plans | Internal Revenue Service Individual Retirement Arrangements (IRAs) Roth IRAs. 401 (k) Plans. SIMPLE 401 (k) Plans. 403 (b) Plans. SIMPLE IRA Plans (Savings Incentive Match Plans for Employees) SEP Plans (Simplified Employee Pension) SARSEP Plans (Salary Reduction Simplified Employee Pension) Payroll Deduction IRAs.

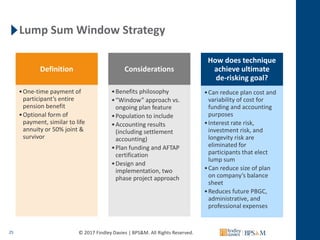

› terms › pPension Plan Definition Aug 30, 2021 · Allocated Funding Instrument: A specific type of insurance or annuity contract that pension plans use to purchase retirement benefits incrementally. The allocated funding instrument is funded with ...

Pension Plan Definition - ThePressFree A pension plan is a retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker's future benefit. There are two main types of pension plans: the defined benefit and the defined contribution plan. A defined benefit plan guarantees a set monthly payment for life (or a lump sum payment on retiring).

› dictionary › pensionPension Definition & Meaning - Merriam-Webster : money paid under given conditions to a person following retirement or to surviving dependents — see also defined benefit plan, defined contribution plan More from Merriam-Webster on pension Thesaurus: All synonyms and antonyms for pension

Defined Benefit Plan | Internal Revenue Service Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more ...

What does pension plan mean? - definitions Here are all the possible meanings and translations of the word pension plan. Princeton's WordNet (0.00 / 0 votes) Rate this definition: pension plan, pension account, retirement plan, retirement savings plan, retirement savings account, retirement account, retirement program noun a plan for setting aside money to be spent after retirement

/Balance_What_Is_A_Pension_And_How_Do_You_Get_One_2388766_V2-c977283a02f54f34ac6f31d018585830-ed6f412b721d4dfc85f6cac9184c78ab.jpg)

/Balance_What_Happens_To_My_Pension_When_I_Leave_A_Job_2063411_V2-45fb62eb90d14d7c834a05988c0b4945.jpg)

0 Response to "42 pension plan definition"

Post a Comment